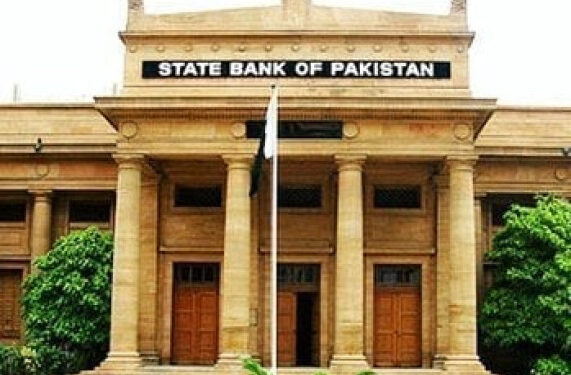

Karachi – The State Bank of Pakistan (SBP) is set to hold a crucial meeting of its Monetary Policy Committee (MPC) today in Karachi. The meeting, which is part of the SBP’s regular schedule, will determine the policy interest rate for the upcoming one and a half months, taking into account the latest macroeconomic indicators, inflationary trends, and financial market conditions.

The outcome of this meeting will be closely monitored by investors, financial institutions, and businesses across the country, as the policy rate directly influences borrowing costs, investment decisions, inflation expectations, and overall economic momentum.

Backdrop: What is the Monetary Policy Committee?

The Monetary Policy Committee (MPC) is a statutory body constituted under the State Bank of Pakistan Act, responsible for formulating and making decisions related to Pakistan’s monetary policy. The committee typically meets every six to eight weeks and is tasked with adjusting the policy rate — also known as the benchmark interest rate — to maintain price stability while supporting economic growth.

The MPC includes members from both within and outside the SBP, ensuring a combination of internal financial expertise and external economic viewpoints. Each decision made by the MPC reflects a deep analysis of key economic factors such as:

- Inflation trends

- Exchange rate movements

- Fiscal developments

- Global oil and commodity prices

- Balance of payments

- Economic growth indicators

SBP Expected to Announce Monetary Policy Decision Today

According to a spokesperson from the State Bank, a comprehensive monetary policy statement will be released after the meeting concludes. This statement will elaborate on the rationale behind the decision, present a review of current economic conditions, and outline forecasts for inflation and economic activity.

This meeting comes at a time when Pakistan’s economy is navigating a delicate balance between stabilizing prices and reviving growth. Inflation, while showing signs of moderation in recent months, remains elevated in some sectors. At the same time, private sector credit off-take and industrial production have been under pressure due to high borrowing costs.

May 2025 Decision: Interest Rate Reduced to 11 Percent

It is important to recall that during the last MPC meeting held on May 5, 2025, the State Bank had cut the policy rate by 100 basis points (1%), bringing it down from 12 percent to 11 percent. That reduction marked the first rate cut in more than a year and was largely welcomed by the business community, financial markets, and economic analysts.

Why the May Rate Cut Was Important:

- The move was seen as a response to a decline in inflation, particularly in food and fuel prices.

- The strengthening of the Pakistani Rupee and improved foreign exchange reserves had provided room for monetary easing.

- The government’s fiscal discipline under the IMF Extended Fund Facility (EFF) had helped stabilize expectations.

That policy rate cut was widely viewed as a pro-growth measure, intended to boost private investment, reduce the cost of financing for businesses, and stimulate consumption, especially in interest-sensitive sectors such as housing, construction, and automobiles.

What Analysts Expect from Today’s MPC Meeting

Economic experts and market analysts are divided over what today’s decision might be. Some expect a further cut of 50 to 100 basis points, while others suggest a pause in rate cuts to evaluate the longer-term effects of May’s decision.

Arguments for a Rate Cut:

- Inflation has continued to show a downward trend, with CPI inflation dropping from double-digit highs to more manageable levels.

- The Pakistani Rupee has shown relative stability in the interbank market.

- International oil prices have remained stable or declined slightly, easing pressure on the current account and domestic fuel prices.

- A rate cut could further stimulate sluggish economic activity, particularly in the industrial and SME sectors.

Arguments for Holding Rates:

- The SBP may want to observe the impact of the previous cut before making another move.

- Core inflation remains sticky, and a premature rate cut might reverse the gains in inflation control.

- IMF conditions, as part of ongoing negotiations for a new bailout package or Stand-By Arrangement, may influence the SBP to maintain a cautious stance.

Potential Impact on Pakistan’s Economy

1. Business and Investment Climate

Lower interest rates generally encourage business expansion and capital investment by reducing the cost of borrowing. A further rate cut would provide breathing room for small and medium enterprises (SMEs), many of whom have struggled under high financial costs.

2. Consumer Spending

Interest rate reductions also have a trickle-down effect on consumer behavior, making loans for cars, houses, and appliances more affordable. This can help revive domestic demand, especially in urban centers.

3. Banking Sector

For banks, rate cuts reduce their profit margins on lending (net interest margin), but they may see an uptick in loan demand, particularly from commercial borrowers and retail clients.

4. Inflation

While a lower policy rate can stimulate growth, it also carries the risk of stoking inflation if not timed correctly. This is especially true in an economy like Pakistan’s, where supply-side shocks (such as wheat shortages or fuel price hikes) are common.

Global and Regional Monetary Policy Trends

Pakistan’s monetary policy cannot be viewed in isolation. Central banks across the globe — particularly in emerging markets — are also adjusting their stances in response to global inflation trends and geopolitical developments.

Examples:

- The US Federal Reserve has paused interest rate hikes, citing easing inflation and slowing economic momentum.

- The Reserve Bank of India (RBI) has maintained a neutral stance, with inflation within its target range.

- Central banks in Bangladesh and Sri Lanka have also cautiously moved toward monetary easing.

In this context, Pakistan’s MPC has a narrow window to support growth without triggering capital flight or exchange rate volatility.

Public and Market Reactions to Monetary Policy

Business Community’s Perspective

Many business chambers and trade associations, including the Federation of Pakistan Chambers of Commerce and Industry (FPCCI), have urged the SBP to further reduce interest rates to support economic revival. They argue that Pakistan’s industrial sector is suffering, and lower rates could stimulate exports and job creation.

Financial Market Outlook

The Karachi Stock Exchange (KSE-100) has historically responded positively to rate cuts, as lower interest rates boost investor sentiment and reduce corporate financing costs.

Conclusion: Eyes on the SBP as Economy Seeks Stability and Growth

Today’s Monetary Policy Committee meeting comes at a pivotal moment for Pakistan’s economy. The decision on the benchmark interest rate will signal the State Bank’s assessment of inflationary pressures, external sector stability, and the overall economic trajectory.

While a further interest rate reduction seems possible, it remains to be seen whether the MPC will prioritize growth or caution in the face of uncertainties around the IMF program, global oil prices, and fiscal deficits.

Whatever the outcome, the monetary policy announcement will be closely watched by economists, investors, business leaders, and ordinary citizens alike, all hoping for a decision that can help steer Pakistan toward macroeconomic stability and sustainable growth.