Islamabad – As Pakistan grapples with a massive informal economy estimated to have exceeded $140 billion, the federal government is considering pivotal steps to transition the country toward a cashless digital economy. In a move that could reshape the financial landscape, a high-level expert committee has submitted its detailed policy recommendations to Prime Minister Shehbaz Sharif, urging a dual approach of incentives and penalties to reduce the dominance of cash transactions.

The committee’s recommendations come at a crucial juncture, as the country prepares for the upcoming federal budget announcement on June 10, which will likely reveal the government’s fiscal strategy and its stance on digital payments.

The Informal Economy: A Hidden Giant

Pakistan’s informal or undocumented economy poses one of the biggest challenges to fiscal transparency, tax collection, and sustainable economic development. According to economists, this parallel economy is not captured in official GDP figures and often evades tax compliance, making it difficult for the government to fund development projects or accurately assess economic health.

A State Bank of Pakistan (SBP) report from recent years had already flagged concerns over the growing size of the undocumented sector. By 2025, estimates now suggest that this grey economy has crossed $140 billion, almost 40% of the formal GDP. This poses major hurdles to improving tax-to-GDP ratio, transparency, and macroeconomic stability.

Two-Pronged Approach: Incentives and Penalties

The expert committee formed by the federal government has recommended a “carrot and stick” strategy. The proposed framework aims to reward digital payment users while discouraging cash usage through fiscal disincentives.

Incentive-Based Policies:

If Prime Minister Shehbaz Sharif chooses to encourage digital adoption, several measures would be implemented, such as:

- Lowering sales tax on digital payments from 18% to 5%.

- Exempting digital transactions from tax audits for three years, thereby building confidence among users and merchants.

- Offering relief on petroleum levy for those paying digitally.

Penalty-Based Policies:

On the flip side, if the government opts to penalize cash users:

- An additional Rs 3 per liter may be charged for cash purchases of petrol.

- Surcharge on government dues paid in cash could be introduced.

- No tax exemption will be granted for Cash on Delivery (COD) transactions, particularly in the booming e-commerce sector.

Budget 2025-26: Finance Minister to Reveal Digital Shift Strategy

All eyes are now on Finance Minister Muhammad Aurangzeb, who is expected to present the annual federal budget on June 10, 2025. The budget is anticipated to reflect the government’s priorities in addressing the cash economy and embracing digital financial services.

The committee’s recommendations could significantly influence policy decisions included in the new fiscal framework. Sources indicate that these measures, if approved, would be rolled out gradually to avoid disrupting business operations, especially for small and medium enterprises (SMEs).

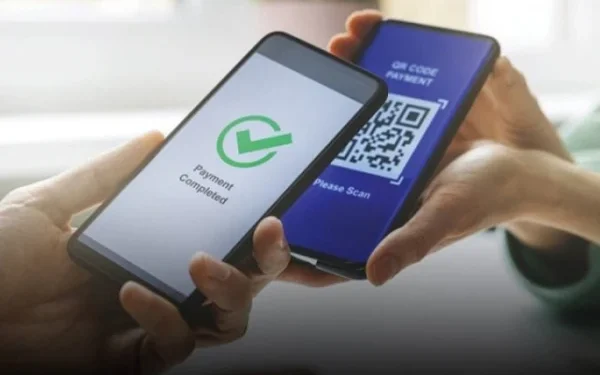

Enabling Infrastructure: QR Code Rollout Over Credit Card Systems

A major component of the proposed digital economy push involves infrastructure changes. The committee has recommended that district administrations be given authority to ensure all retail shops install RAAST QR codes.

RAAST, the instant payment system launched by the State Bank of Pakistan, provides a low-cost and scalable alternative to traditional Point-of-Sale (POS) machines. Currently, there are only around 50,000 credit card terminals nationwide, serving an estimated 5 million retail shops, a ratio that is grossly inadequate.

RAAST QR codes offer a cost-effective, secure, and inclusive method to receive payments directly into bank accounts. This could bring millions of retailers into the documented economy with minimal setup costs.

Opposition from FBR? IMF Shows No Objection

While the Federal Board of Revenue (FBR) initially expressed reluctance to reduce sales tax, citing concerns that the International Monetary Fund (IMF) might oppose such measures, the committee reached out to IMF officials for clarity. Surprisingly, the IMF did not object to incentivizing digital payments through tax relief, provided the broader fiscal impact is manageable and the long-term goal is increased documentation.

This response from the IMF could pave the way for the government to proceed with reforms without risking the $6 billion Extended Fund Facility (EFF) or its anticipated follow-up program.

Telecom Sector: Tax Regime Hurting Digital Inclusion

Telecom companies, which are vital to digital transformation, have raised red flags over the existing tax regime, calling it counterproductive and economically damaging. Key concerns include:

- The 4% withholding tax on mobile usage, which telecom operators argue should be made adjustable.

- Advance income tax policies, including a 75% minimum tax on inactive users and penalties like SIM card blocking, have proven ineffective and burdensome.

- A complicated tax deduction process on every digital transaction increases overhead costs and discourages innovation.

Telecom players have demanded reforms that would make income tax adjustable instead of fixed, particularly during loss-making quarters. This would help align digital expansion with profitability, especially in underserved regions.

State Payments Must Go Digital: Committee Recommends

A significant proposal by the committee is to digitalize all government disbursements. This includes:

- Payments made to Benazir Income Support Programme (BISP) beneficiaries.

- Contracts and invoices paid to vendors and service providers working with government departments.

Moving away from manual or cash-based payments can enhance transparency, reduce leakages, and improve efficiency in public sector financial management.

The Case for a Cashless Economy in Pakistan

Globally, the shift toward cashless economies has yielded significant benefits:

- Improved tax collection and revenue forecasting.

- Lower administrative and operational costs for businesses and governments.

- Enhanced financial inclusion, particularly through mobile wallets and branchless banking.

In Pakistan’s context, promoting digital payments could also reduce the risks associated with money laundering, terror financing, and corruption.

Challenges Ahead: Behavioral and Technological Barriers

Despite the proposed benefits, Pakistan faces several hurdles in implementing a fully digital economy:

- Low financial literacy and digital skills in rural areas.

- Trust deficit in the banking system, especially among small traders.

- Cybersecurity concerns and fear of fraud in digital transactions.

- Inadequate internet penetration in remote areas, despite 3G/4G coverage expansion.

Addressing these concerns will require a comprehensive public awareness campaign, technological investments, and a strong regulatory framework.

Conclusion: A Defining Moment for Economic Reforms

With the submission of the expert committee’s recommendations, Pakistan stands at a crossroads in its economic reform agenda. The push for a cashless economy, if strategically implemented, could unlock vast potential in terms of revenue generation, financial inclusion, and transparency.

As Finance Minister Muhammad Aurangzeb finalizes the upcoming budget, all stakeholders—from telecom operators and fintech startups to retailers and consumers—await the government’s decision. The upcoming months will be crucial in determining whether Pakistan finally embraces the digital age, or continues to struggle under the weight of its undocumented, cash-dependent economic model.