Islamabad : In a significant policy shift aimed at promoting renewable energy and reducing dependency on fossil fuels, the National Assembly of Pakistan has approved the reduction of sales tax on solar panels from 18 percent to 10 percent. This decision was part of the broader Finance Bill 2025, which was passed during the National Assembly session chaired by Speaker Ayaz Sadiq.

The approval came as part of the federal budget for the fiscal year 2025-26, which has a total outlay of Rs 17,573 billion. The finance bill, with several amendments and fiscal reforms, was passed by a majority vote, signaling the government’s intent to support clean energy solutions amid rising energy demands and climate change challenges.

Key Highlights of the Finance Bill 2025

During the session, Finance Minister Muhammad Aurangzeb presented various motions for the approval of the Finance Bill. After majority approval, a clause-by-clause voting process was undertaken. Notable approved provisions included:

- Amendment for arrest powers in sales tax fraud cases.

- Imposition of a Rs 2.50 per liter carbon levy on petroleum products.

- Amendments to laws governing MPs’ salaries, including the Salaries and Perks of Members of Parliament Act.

- Changes to the Customs Act 1969 and the Income Tax Ordinance, particularly regarding taxes on salaried individuals.

- Reduction of sales tax on solar panels to 10 percent.

- Approval of the overall Rs 17,573 billion federal budget.

These changes are part of a comprehensive fiscal framework intended to broaden the tax base, improve compliance, and stimulate priority sectors, such as renewable energy.

Sales Tax Reduction on Solar Panels: A Strategic Move

Background on Solar Panel Taxation

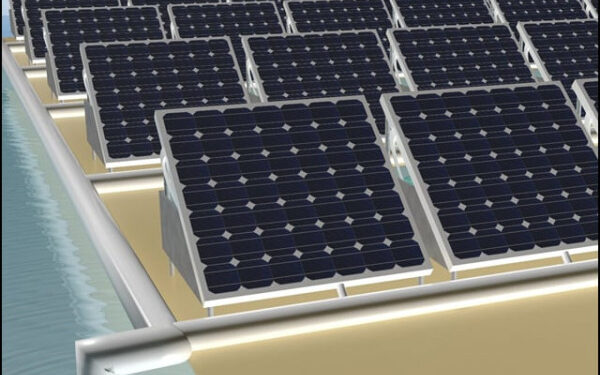

Until now, the import of solar panels in Pakistan was subject to an 18 percent sales tax, which was a point of concern for clean energy advocates and consumers alike. The tax burden increased the cost of installing solar power systems, discouraging households and businesses from making the switch to renewable energy sources.

In recent years, Pakistan has witnessed a surge in solar panel imports as the country struggles with load shedding, rising electricity tariffs, and climate change impacts. According to data from the Alternative Energy Development Board (AEDB), the demand for solar systems has increased dramatically, especially in rural areas and commercial zones.

Why the Tax Reduction Matters

The decision to reduce the tax rate to 10 percent is seen as a pro-growth and pro-environmental policy measure. It will help make solar energy more affordable and accessible, especially for middle-income households and small businesses. The new tax rate also aligns with Pakistan’s commitment to the Paris Climate Agreement and its Nationally Determined Contributions (NDCs) to reduce greenhouse gas emissions.

Ishaq Dar’s Remarks on the Solar Tax Adjustment

Speaking in the Senate earlier, Deputy Prime Minister and Foreign Minister Senator Ishaq Dar confirmed the government’s decision to slash the tax rate on solar panels. He emphasized that nearly 46 percent of materials required for solar systems are imported, making it necessary to reduce the overall tax burden.

“It was necessary to reduce the tax from 18 percent to 10 percent, especially when we are importing nearly half the components required for solar setups. This step will encourage green energy adoption in the country,” said Dar.

He further stated that the government is focusing on long-term sustainability and energy independence by investing in clean energy infrastructure.

Impact on the Solar Energy Market in Pakistan

The revised sales tax rate is expected to have a positive ripple effect across the solar energy value chain in Pakistan. Here’s how:

1. Lower Installation Costs

Reduced taxation will lower the cost of rooftop solar installations for residential and commercial consumers. It is estimated that the average household could save Rs 50,000 to Rs 100,000 on a standard 5kW solar system.

2. Boost to Local Solar Industry

With more affordable imports, local suppliers and installation companies are expected to see an increase in demand. This may lead to job creation, skill development, and business growth in the solar industry.

3. Progress Toward Renewable Energy Goals

The government has set a target of generating 30 percent of electricity from renewable sources by 2030. Reducing the sales tax on solar equipment is a direct move in line with this strategic goal.

Federal Budget 2025-26: A Broader Economic Vision

Beyond energy reforms, the Rs 17.573 trillion federal budget encompasses a series of measures aimed at fiscal discipline, revenue generation, and socio-economic development.

Key Components of the Budget:

- Rs 462 billion in new tax measures.

- Adjustments in the investment income tax regime.

- Proposed mini-budget worth Rs 36 billion to support salary increments and essential services.

- Relief for non-filers in selected investment categories.

- Increased allocation for higher education, particularly universities in Sindh province.

The Finance Committee of the National Assembly, chaired by Syed Naveed Qamar, has approved these fiscal initiatives after extensive consultations, including six meetings with allied parties, as confirmed by Ishaq Dar.

Stakeholder Reactions to the Solar Tax Cut

Clean Energy Advocates

Environmental groups and clean energy campaigners have welcomed the decision. The Pakistan Solar Association issued a statement saying, “This is a monumental step forward. We’ve long demanded tax reforms to make solar technology more accessible.”

Business Sector

Small and medium enterprises (SMEs), which often face power shortages and high utility bills, are optimistic that cheaper solar installations will reduce their operating costs.

Public Sentiment

Social media reactions have largely been positive, with users praising the move as “forward-thinking” and “essential for Pakistan’s energy crisis.”

Conclusion: A Ray of Hope for Clean Energy

The approval of a reduced sales tax rate on solar panels as part of the Finance Bill 2025 is a clear indication that the government recognizes the importance of renewable energy in achieving energy security and economic resilience.

By lowering the cost barrier for solar energy adoption, the government is empowering citizens, protecting the environment, and supporting the country’s transition to a sustainable energy future. With global energy dynamics shifting and climate change pressures mounting, such proactive fiscal policies are not just commendable—they are essential.