Trump’s new tariffs may raise iPhone prices in the U.S. by up to $700, making Apple products more costly for millions of users.

Trump Tariffs May Hike iPhone Prices by $700 in U.S.

As part of a larger plan to reduce America’s reliance on foreign products, U.S. President Donald Trump has implemented new tariffs, or taxes on imported goods, which are likely to make popular items like iPhones much more expensive for U.S. consumers. As a result, the price of the iPhone in the United States may increase significantly shortly, possibly by as much as $700.

Tariffs:

A tariff is a type of tax imposed by a nation on commodities imported from other nations. Tariffs are typically used by governments to punish other nations in trade wars or to safeguard domestic companies. President Trump has imposed heavy tariffs on many nations, including China, in this instance. Apple now has to pay more to import its products into the US because the majority of its products, including the iPhone, are manufactured in China.

Tariff on Chinese Products:

China is now facing a 54% tariff under Trump’s new policy. This means that for every $100 of goods Apple imports from China, it now has to pay $54 extra to the U.S. government. That’s a huge increase in cost and it is not just iPhones that are affected. Many other Apple products, like iPads, AirPods, and Macs, are also made in China.

What Could Happen to iPhone Prices?

Because of the 54% tariff, Apple must decide what to do next. It has two main options:

- Absorb the cost: Apple pays the extra money itself, which will reduce its profit

- Pass the cost to customers: Apple increases the price of the iPhone and other products.

Analysts believe that Apple will likely pass most of this cost on to consumers. According to Rosenblatt Securities, this could raise iPhone prices by 30% to 43%.

Here are some estimated price increases based on Rosenblatt’s report:

- iPhone 16 (Base Model)

- Current Price: $799

- New Price (after 43% increase): $1,142

- iPhone 16 Pro Max

- Current Price: $1,599

- New Price (after 43% increase): $2,286

This means a regular iPhone could cost over $300 more, and the Pro Max model could cost around $700 more.

About Other Apple Products:

It’s not just the iPhone that’s going to get more expensive. Other Apple products will likely face similar price hikes:

- Apple Watch: Price may go up by 43%

- iPads: Expected to increase by 42%

- AirPods and MacBooks: Prices could increase by 39%

Apple sells millions of these products every year. So even a small price increase can make a big difference to the company and its customers.

Apple’s Dilemma:

Apple is currently in a difficult position. Customers may cease purchasing new products or put off upgrading if prices rise. Sales may decline as a result of this. However, Apple may lose billions of dollars in profits if it chooses to pay for the expenses alone. According to analysts, Apple may have to pay up to $39.5 billion in costs as a result of these levies. Even for a corporation the size of Apple, that is a staggering figure.

Apple’s Stock Drops:

News of the tariffs has already affected the company badly. Apple’s stock price dropped by 9.3% in one day, its worst single-day performance since March 2020, when the COVID-19 pandemic caused global panic.

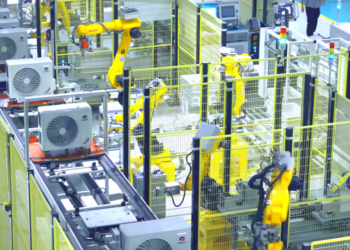

Why Is Apple So Dependent on China?

One might wonder why Apple can not just move its manufacturing to another country. It is not so easy. Apple has been working with Chinese factories for many years. These factories are highly efficient and have millions of skilled workers. Moving production to another country like India or Vietnam takes a lot of time, planning, and money. While Apple has already started shifting some of its production to India, most iPhones and other Apple products are still made in China.

What Could Apple Do?

Here are a few possible options Apple might consider:

- Raise Prices: As already discussed, Apple might increase the cost of its products.

- Shift Production: Apple may speed up its plan to move production to other countries like India, Vietnam or Mexico.

- Negotiate Exceptions: Apple could try to work with the U.S. government to get exceptions for certain products.

- Redesign Supply Chains: Apple might change how and where parts are made and assembled to avoid high tariffs.

Consumers:

If prices go up, many customers may think twice before buying a new iPhone. They may

- Wait longer before upgrading

- Choose older or cheaper models.

- Consider switching to Android phones.

This would hurt Apple’s sales and may also change the smartphone market as a whole.

iPhone Market:

Apple sells more than 220 million iPhones every year. The United States, China, and Europe are its biggest markets. If just a small percentage of customers in these regions stop buying or delay their purchases, Apple could lose billions of dollars.

Global Impact of Tariffs:

These tariffs do not just affect Apple. They could hurt the global economy in many ways:

- Higher prices for many tech products

- Slower innovation as companies cut spending

- Reduced demand due to the expensive device

- Unemployment in countries that depend on manufacturing for Apple

Will These Tariffs Help the U.S.?

President Trump’s goal is to make American companies less dependent on China and bring jobs back to the U.S. However, experts say that it may take years to rebuild the kind of supply chain Apple has in China. In the short term, American consumers may end up paying more. And Apple, one of the most valuable U.S. companies, could lose its competitive edge.

Conclusion:

The new tariffs by President Trump are making waves in the tech industry. Apple, one of the world’s biggest tech companies, is right at the centre of this storm. With China facing a 54% tariff, the cost of making iPhones and other Apple products has gone up dramatically. If Apple passes these costs on to customers, we may soon see iPhones priced as high as $2,300 in the U.S. A huge jump that could affect millions of users. For now, consumers, investors, and Apple itself are waiting to see how things unfold. One thing is certain the world of smartphones is about to get a lot more expensive.